Get to the Point – April 2022

Thank you for taking a listen to Propel’s Get to the Point audio. Can we all please stop being so hyperbolic? When we’re in the midst of a record-setting year in the history of Canadian real estate, everyone thinks it can only get better. The sky’s the limit. Now that it appears that we may actually be on the verge of experiencing some relief, apparently it’s the end of the real estate market as we know it.

What’s even more confusing, those that have been waiting for an opportunity to purchase real estate without having to sprint from showings to an offer, that btw typically have been without a due diligence periods and almost always well over asking price, are now second guessing themselves. Listen, as a whole, it’s true the Canadian real estate market is finally shifting down gears and the increasing interest rates could continue the cooling effect.

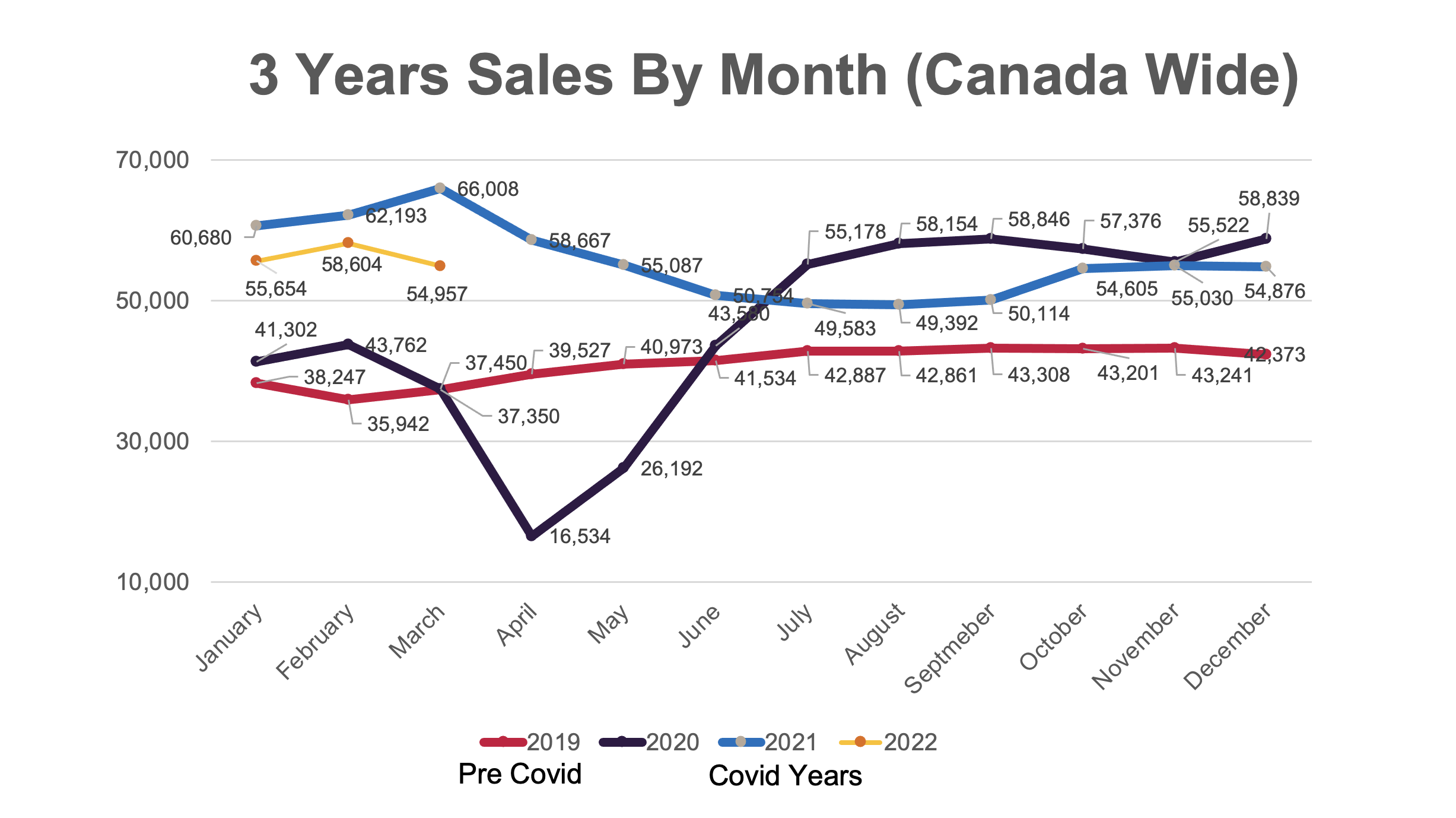

What’s also quite evident is that we are still in a pretty healthy real estate market. Have a look at the chart of sales figures across Canada. It’s fair to make both of the following statements, we are seeing a decline in sales AND we have really strong sales figures, historically speaking. It’s not as though sales have not ground to halt. rather the market is adjusted from what I would categorize as “ballistic” back to long run 10 year sales averages.

Also, keep in mind March may have borrowed some demand from April thus amplifying the rate of change between the two months. So could it be true that comparing the current market a record setting year in the history of Canadian real estate, might artificially skew our perspective? 2021 was an anomaly folks, NOT the norm. And for those of us with short memories, a slower pace of the market was expected, but not until the later half of the year.

A strong surge for the first half of 2022 to capture the lower rates with a more stable market for the later half of 2022 was on everyone’s radar. The bank of Canada had signaled rate increases for 2022 as far back as summer 2021, however it was implied the tightening of rates would happen more gradually than what has taken place over the 4 months.

Locally speaking, We are still under 10,000 listings and we need to be between 16,000 & 18,000 for markets to be in balance and to slow price growth substantially. Lastly, I’ll circle back to my trusty cow-bell, the MOI metric. April’s MOI stood at 1.9 which is quite low. And for those of you keep tabs, MOI was 1.8 in January, 1.6 in February and 1.5 in March

So what’s the point? The second half of the year has arrived earlier than we had expected. We might actually be heading towards the realm of stability. We’re on the the path of getting what we all wished for so let’s be grateful and enjoy it. What a crazy thought.